Planning Ahead for Life After Death

Death is not something we like to talk about. But it is a life event for you as much as for your family members, and it affects them more because they continue to live with the changes that come with your passing.

Preparing ahead for how your estate will be managed and distributed in the event of your death will help your loved ones avoid unnecessary stress and uncertainties during a time when they most need peace of mind, and help you plan for their continued welfare and well-being in your absence.

This FAQ will address some basic questions on key elements of an estate plan: wills, trusts and CPF nominations.

WILLS

Why do I need a will?

Your will determines how your estate, which is all your movable and immovable assets, will be distributed when you pass away. Without a will, the courts decide what happens to your assets and the process can drag to as long as 5 years before the estate is distributed.

Do I need to engage a lawyer to draw up my will?

Although not strictly necessary, it’s best to consult a legal professional and engage one to write your will, due to the various provisions under the Wills Act that you need to comply with for the will to be valid, and not disputable.

How much is it to set up a will?

A will is priced according to the number of clauses included. Simple wills might be drawn up for S$350-400 while more complex wills might cost around S$2,000.

What should I do after I draw up a will?

Keep a copy in a safe place and let your family members know of its existence.

Also approach the Wills Registry to deposit information of the will

What happens if I pass away without a will?

If you pass away without leaving behind a will - known as dying "intestate" - your assets will be distributed under Singapore’s Intestate Succession Act. The court is empowered to appoint whoever it thinks ought to be granted the letters of administration, which serve as a court order authorising a person to be appointed as the administrator to administer the estate and distribute the assets in accordance to Singapore’s laws.

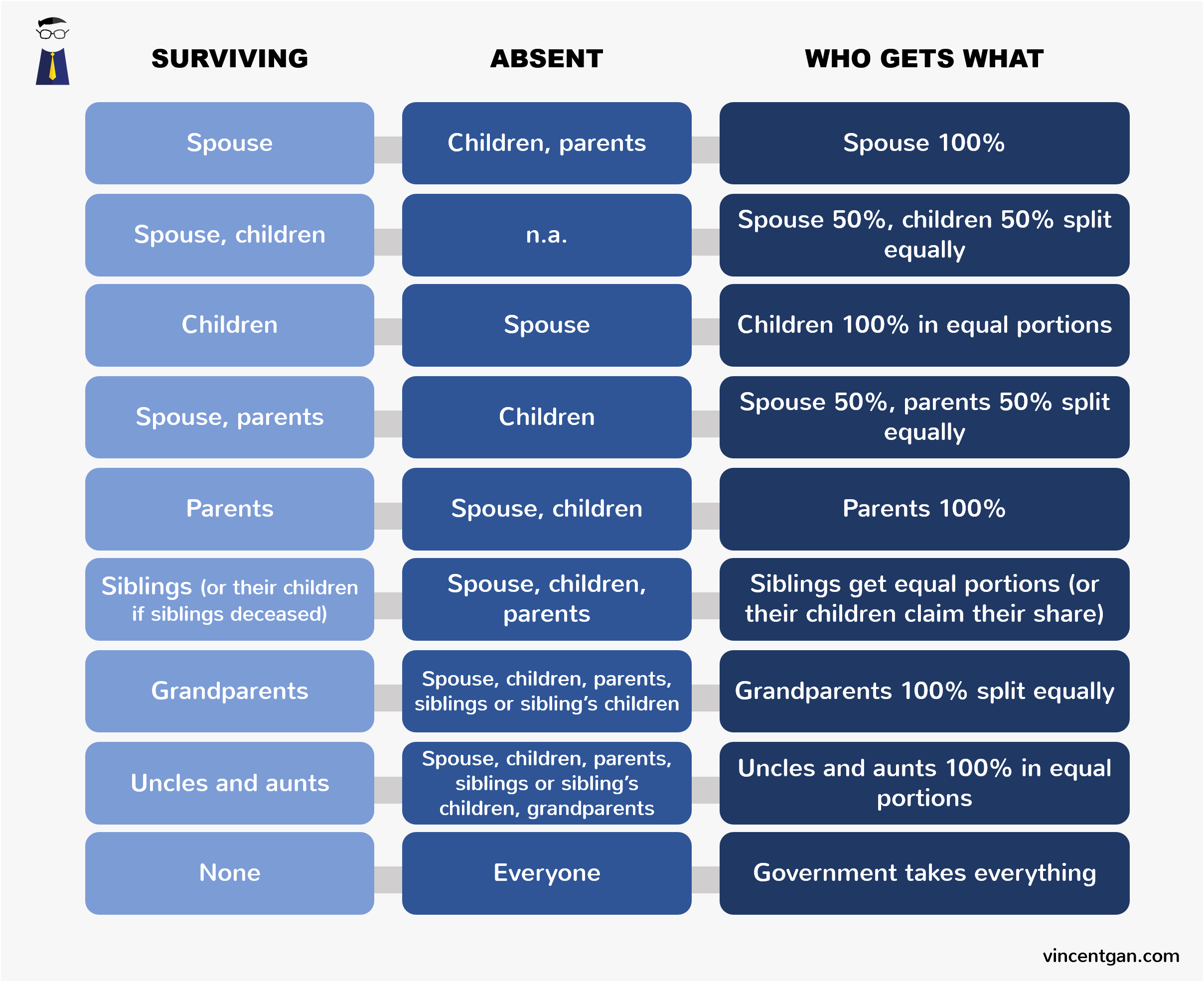

The Act sets out 9 simple rules to determine how assets are distributed after all owed taxes and debts are paid, in the following order:

Note that the Intestate Succession Act does not apply to Muslims. The distribution of property of a deceased Muslim domiciled in Singapore at the time of death is governed by Muslim law and the Syariah Court.

TRUSTS

I'm not Bill Gates. Why do I need to set up a trust?

A trust is a legal entity that lets you put conditions on how certain assets are distributed upon your death. It may be created by contract, will, or deed, collectively known as the trust instrument. The trustee you select must follow the instructions you put in your trust. Your trust could allow the trustee to invest the funds or keep the money in the trust for years and have the trustee make distributions as needed.

For example, if your beneficiaries are too young to make financial decisions, you can consider appointing a trustee to manage your assets until they come of age. Trusts can also be used in conjunction with wills as a means to transfer and divide property amongst relatives after death.

You don't need to be Bill Gates to set up a trust. It is a useful estate planning tool for many. But given the cost and complexity associated with setting up one, it's probably not practical or worth it unless you have a certain amount of assets. A good rule of thumb is above S$200,000. Trusts help to minimize estate taxes and protect your estate from courts, creditors and irresponsible spending.

Do note that a trust does not replace a will. Most trusts cover specific assets, not everything in your estate.

What kinds of trust are there?

1. Living trust: is set up during a person’s lifetime. Living trusts can be

Revocable: You retain control of all the assets in the trust, and you are free to revoke or change the terms of the trust at any time.

Irrevocable: The assets in it are no longer yours, and typically you can't make changes without the beneficiary's consent.

2. Testamentary trust: is set up in a will and established only after the person's death when the will goes into effect.

Should I engage professional trust services?

Due to the complexity and onerous requirements, it is best to engage professional services to create a trust, like a trust lawyer or trust company. Banks and financial services firms, like Great Eastern Financial Advisory, also provide such services. They can guide you through the different types of trusts that best suits your assets and goals, and help ensure it is legally sound.

How much is it to set up a trust?

It depends on the type of trust to be set up. Insurance trusts and mass affluent trusts are around S$3,500, while a customized family and private trust might need around S$10,000.

CPF NOMINATIONS

Why do I need to make nominations?

Your CPF savings can also be distributed like your other assets, through a CPF Nomination, which specify who will receive your CPF savings, and how much each nominee should receive, upon your passing.

Do note that nominations done before marriage will be automatically revoked at marriage.

What are the nominations I can make for my CPF savings?

Cash Nomination - Your CPF savings will be paid in cash via cheque or GIRO to your nominees upon your death.

Enhanced Nomination Scheme - Your CPF savings will be paid to your nominee's CPF accounts, instead of in cash.

Special Needs Savings Scheme - Parents can nominate their child/children with special needs to receive monthly disbursements from their CPF savings upon their death.

If you have bought insurance policies or invested under the CPF Investment Scheme, note that these will not be covered under the CPF Nomination and will be distributed according to instructions in your will.

What if I pass away without making nominations?

Should you pass away without making a Nomination, your CPF savings will be distributed under Singapore’s intestacy laws or Muslim inheritance laws.

See how to make your CPF Nomination here.