How to Grow My Money (Part 2): What Factors to Consider When Starting to invest

Now that we understand the different types of options available to us in terms of asset classes, let’s go deeper into how we should consider these options for investment.

So I have a fondness for taking people back to their childhood. The last time round we revisited video games and collector’s cards. This time, I’m taking you back to Math class! (Don’t hate me)

The RITE Way of Looking At Investments

My favourite way of looking at investments is using the mnemonic RITE, which stands for Risk, Interest Returns, Time Horizon and Expectations.

Risk & Interest Returns

Risk and return tend to go hand in hand. All investments carry some risk. Some people are therefore more willing to hold risky assets in their portfolio because it offers potential for higher returns. Typically, people have a mix of assets to balance risk and return. Let’s the take example of stocks versus bonds. Historically, stocks have greater volatility in returns, hence they are considered the riskier investment. Even within the asset class of stocks, some are considered riskier than others, for example, those with large price swings which have high unpredictability. For such stocks, the potential return is high if you managed to cash out when the price is at a high. The amount of risk you can take depends on your risk tolerance, which is defined as your ability and willingness to lose some or all of your original investment, at least temporarily, in exchange for greater potential returns.

Time Horizon

This is the length of time you can keep your money invested before you need it again. If you have a long time horizon, you can wait out any large dip in your investment value in difficult markets or economic cycles. The shorter your time horizon, the less risk you can take because you might not have time to recover any short-term losses incurred and might be forced to withdraw during a dip in investment value.

Expectations

This is what you expect from investing your money, i.e. your investment or financial goals. Your goals will determine the kind of returns you are looking for and hence the kind of risks you need to undertake.

As you can tell, the interaction between your risk, interest returns and time horizon influences your investment decision. But it all seems rather circular, one affects the other, which affects another. How should you start thinking about this?

Back to Math Class...

Do you remember your DST triangle? It was the easy way to remember the distance, speed and time equations. I recall always drawing it out at the corner of my exam paper to refer to! (memories…)

Similarly, the way we can remember how to relate Risk, Interest Returns and Time Horizon by putting them in a triangle.

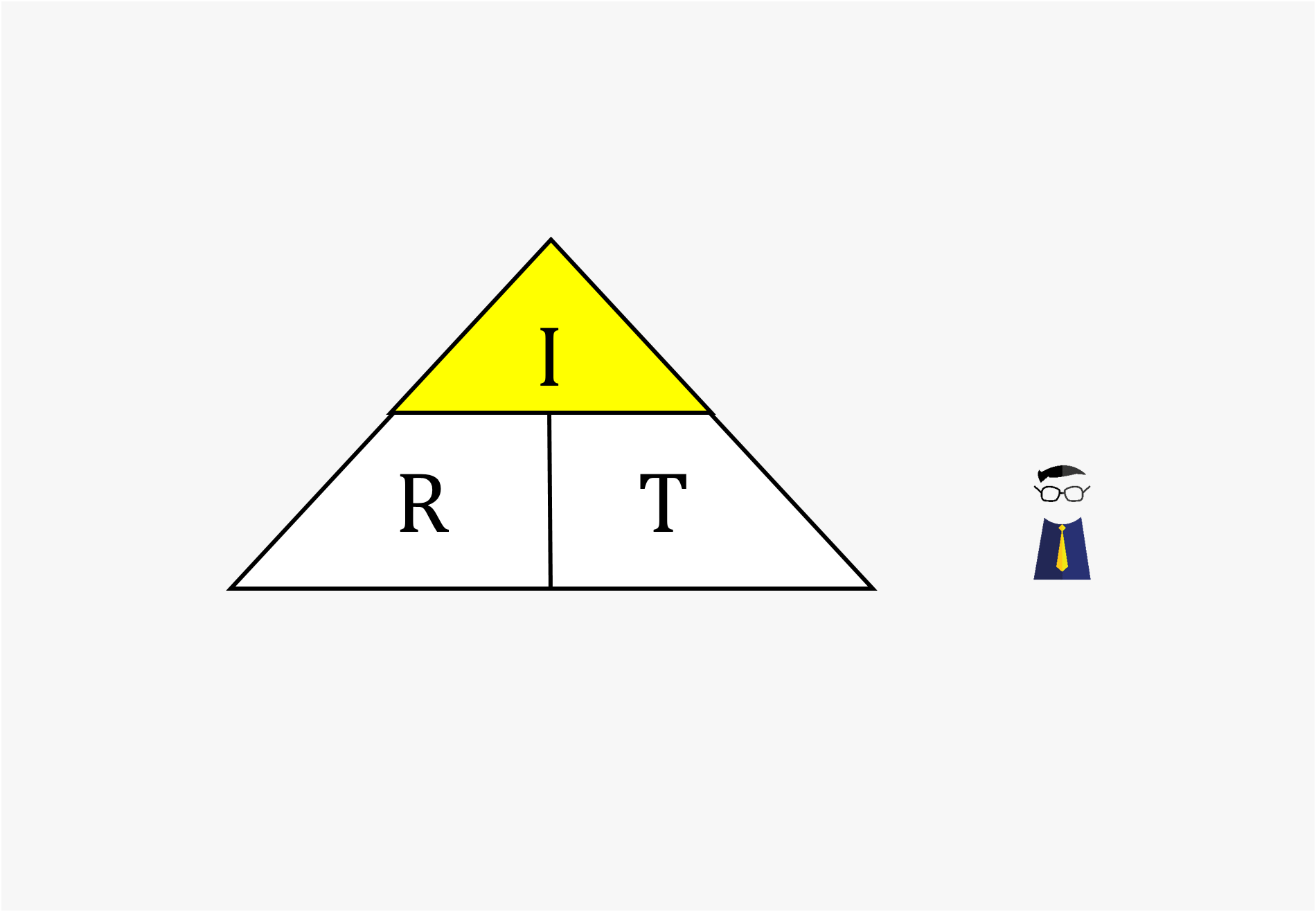

Let’s look at them this way:

1. If we keep interest (I) constant, for risk (R) to decrease, time (T) must increase

If you have an investment goal that requires a certain return level from your portfolio, but you cannot afford to risk losing your money at this point in time and need to invest in less risky assets, then you must have a longer time horizon for your portfolio to grow to reach your goal.

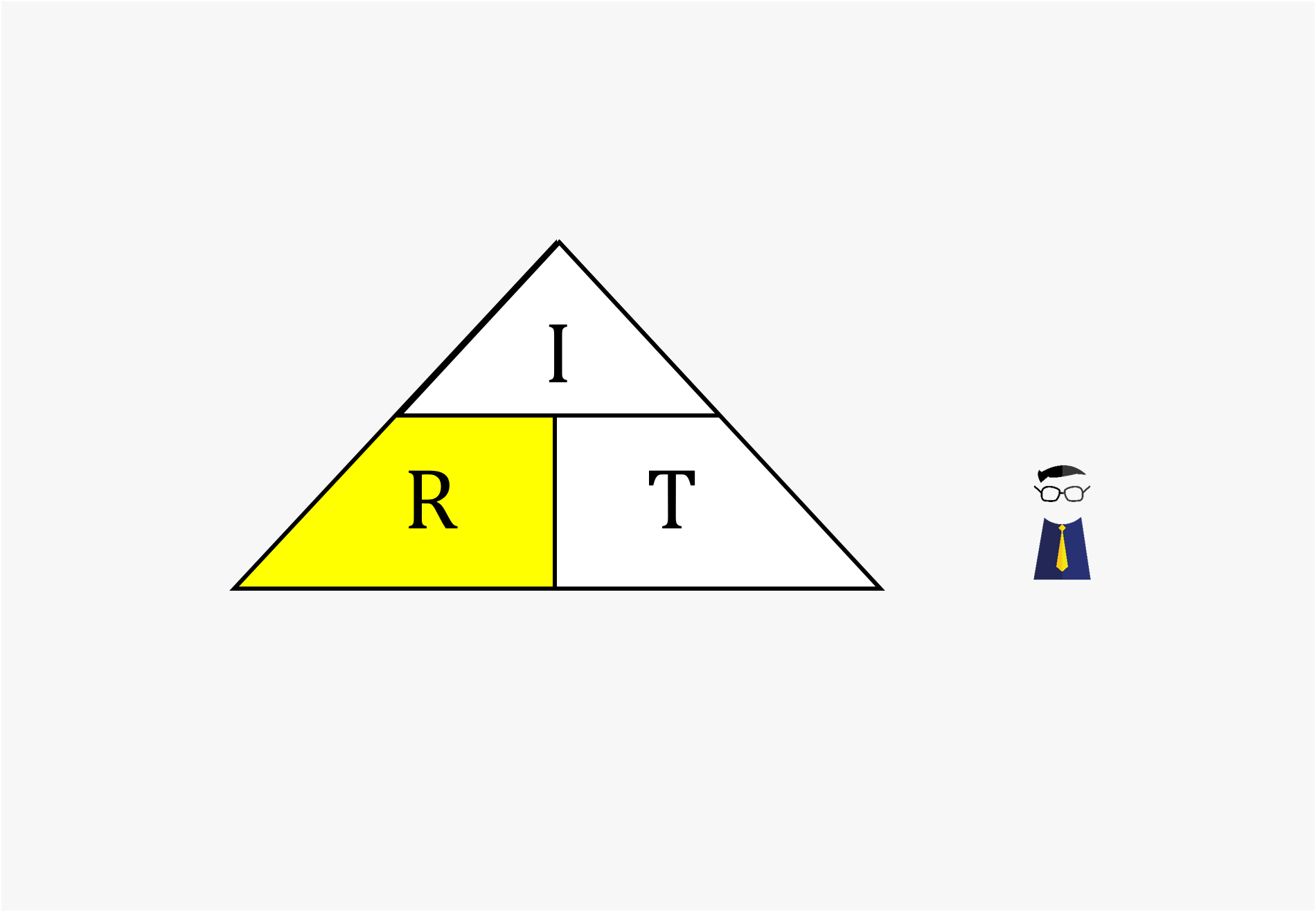

2. If we keep risk (R) constant, for interest (I) to increase, time (T) must increase

If you cannot take on additional risk for your portfolio but wish to grow the returns, you must have a longer time horizon to reach your investment goal.

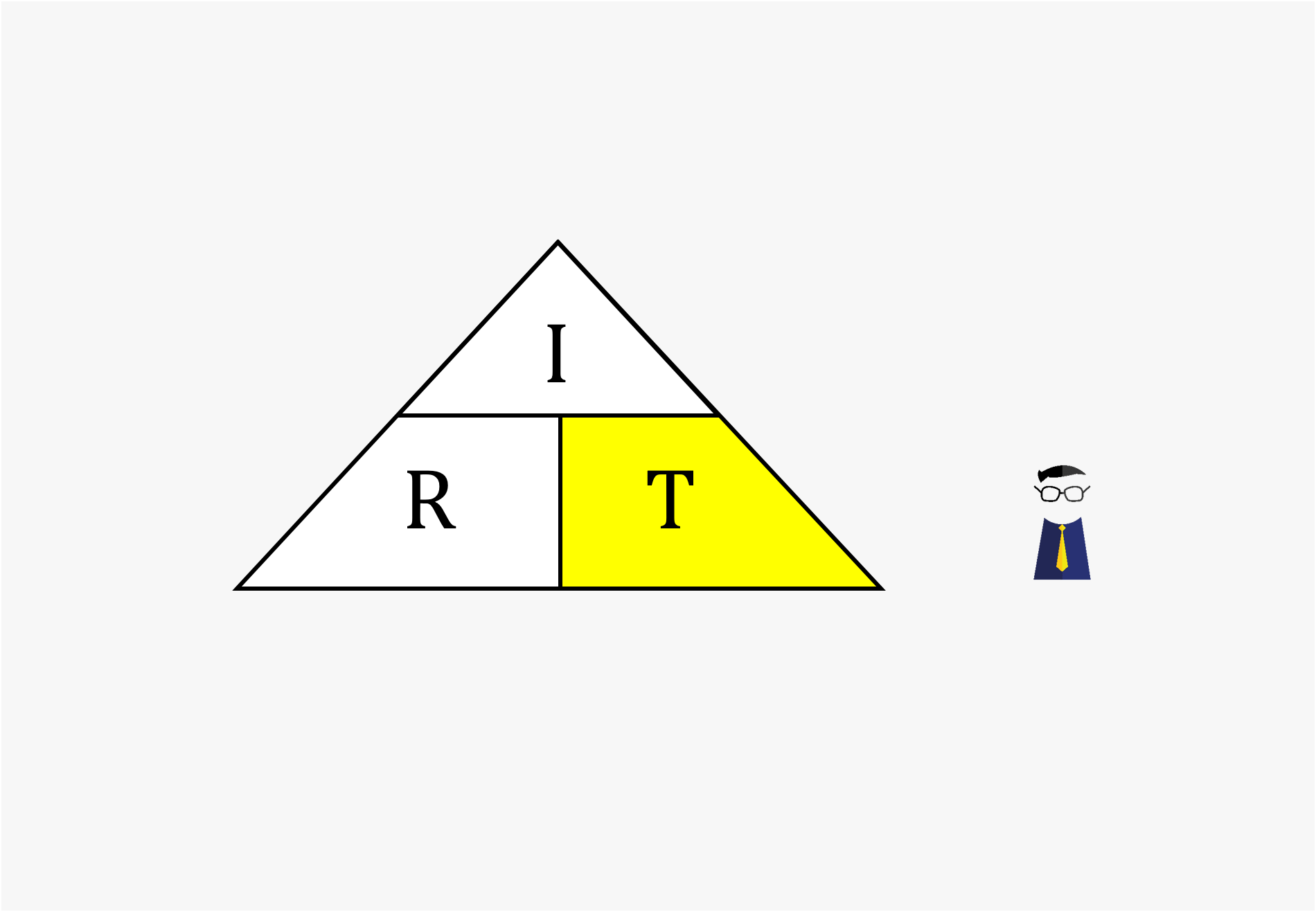

3. If we keep time (T) constant, for interest (I) to increase, risk (R) must increase

If your time horizon is pretty much set in stone, for example, you are retiring in 15 years’ time, then in order for your returns to grow to reach your investment goal, you have to take on higher risk for your portfolio.

And how does Expectation (E) relate to these? It is the overarching factor that holds the triangle together. If you want to have control over the three factors R-I-T, you will need to adjust your Expectations.

What To Do Next?

So Math class is over, it wasn’t that hard, was it? Keep that triangle in mind and you will find it easy to recall the important factors to consider in your investments.

Once you understood these principles, you can try this approach for considering what to invest in.

If you have a financial advisor, he or she can help you with this process, especially with steps 4-6, and particularly if you have many Expectations to balance. Revisit your RITE regularly as they can change over time. For example, your time horizon inevitably becomes shorter and you will need to adjust your risk and return profile for your portfolio.

Make sure your advisor understands your expectations and time horizons, so that he or she can advise how best to align your portfolio and allocate to products you are comfortable with, while offering the greatest potential growth.